Every penny counts – especially when your project is on the verge of being unprofitable. But how to avoid that scenario from coming true in the first place? That’s where project financial management comes in.

What Is Project Financial Management? Definition

Project financial management is the process of planning, monitoring, and controlling the financial resources of a project to ensure its a successful project execution within budget. The objective of this operation is simple: to maximize the profits and customer satisfaction rates while minimizing the risk and additional cost.

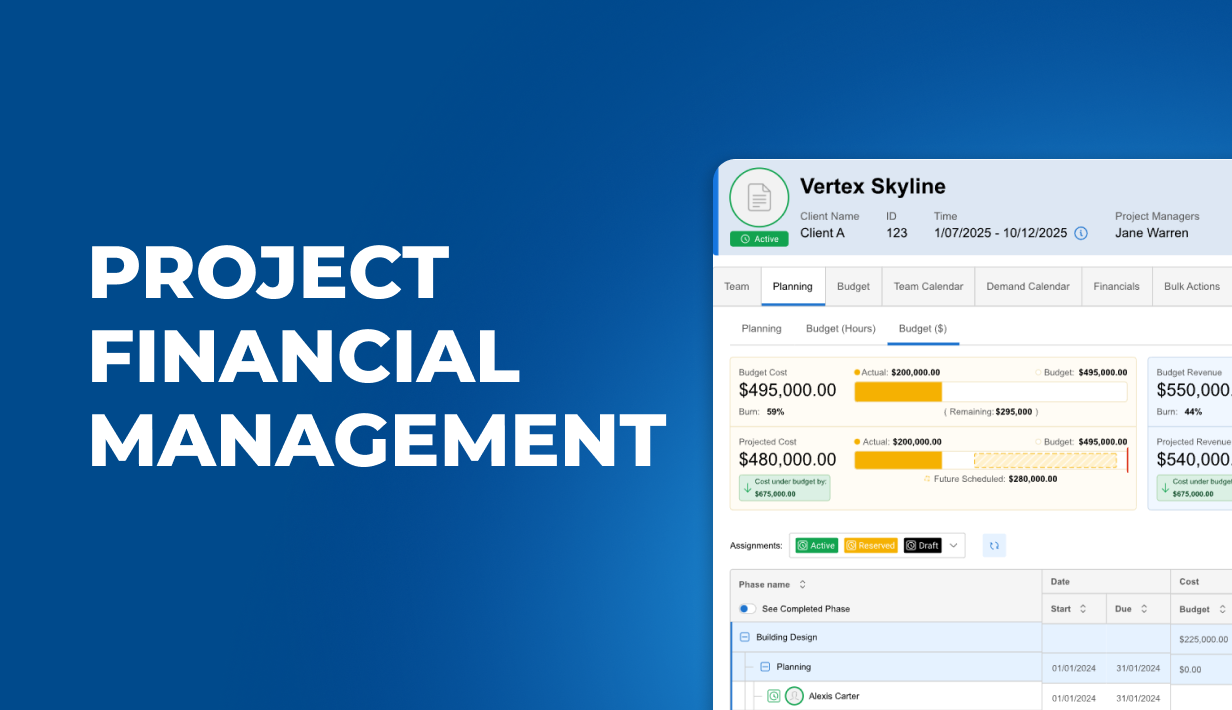

Project expenses and incomes in project budget in BigTime

What Is Included in Financial Management for a Project?

Generally, financial management in project management involves:

- Setting financial goals at the beginning of the project. For professional services, that usually means identifying the target profit margin.

- Estimating costs of the entire project. That involves not only calculating the costs of work, but also adding both project and company overheads to the equation.

- Managing cash flow as the project progresses and making necessary adjustments to the project budget whenever necessary.

- Tracking expenses throughout the project. This can be done by monitoring work costs and overheads in designated tools. BigTime’s project management software includes that feature!

- Analyzing project’s financial performance both during and after the project to improve similar endeavors in the future.

What Are Project Financials – And Which Ones Should You Monitor?

In financial management, knowing the indicators to look out for is the key to focusing on the growth, instead of the analysis itself and making financial impact. That requires knowing your project financial metrics.

By definition, project financials refer to the complete set of financial data and metrics associated with a specific project. Managing them involves tracking and analyzing this data throughout the project lifecycle to ensure profitability, support decision-making, and align outcomes with business objectives.

But which of those metrics are key for an accurate project budget?

Which Project Financial Management Metrics Should Services Companies Measure?

Project Costs

Project costs are all expenses incurred in the planning, execution, and delivery of a project. This includes direct costs—such as labor, materials, subcontractor fees, and software—as well as indirect costs like overhead, administrative expenses, and resource utilization.

Project Revenue

Project revenue is the total income a business earns from delivering a specific project. It typically includes billings based on time and materials, fixed fees, milestones, or retainers—depending on the contract terms. In project financial management, project revenue is tracked alongside project costs to assess profitability as the operation progresses.

Project Profit Margin

Project profit margin is a financial metric that measures the percentage of profit generated from a project relative to its total revenue. Typically, in professional services companies, profit margin varies from 10 to 40%.

Key Metrics for Financial Management

Good financial practices don’t stop at those basic calculations. There are also other project metrics that are an essential part of financial reporting that all project managers should track to evaluate project’s financial health. Those include:

- Budget Variance that measures the difference between the planned budget and actual spending. It shows which projects are underperforming.

- Cost Performance Index (CPI) evaluates cost efficiency by comparing earned value to actual costs. A CPI above 1 indicates cost efficiency (under budget), while a CPI below 1 signals overspending.

- Earned Value represents the value of work actually completed to date. It allows project managers to measure progress against the project plan, helping to assess whether the project is on track.

- Planned Value is the estimated budgeted cost of work scheduled to be completed by a specific time. It serves as a baseline for comparing actual performance and earned value, and is essential for analyzing schedule adherence.

- Estimate at Completion forecasts the total expected cost of the project based on current spending trends and performance. It helps stakeholders understand if the project is likely to stay within budget or require additional funding.

- Return on Investment measures the profitability of a project relative to its total cost. It’s a high-level indicator used by executives to determine whether a project delivers sufficient value to justify the investment.

- The Billable Utilization Rate tracks the percentage of time team members spend on billable work (or the work on customers’ projects) versus total available work hours.

How Does Financial Management Combine with Project Life Cycle?

Effective project financial management doesn’t start when the project does. It starts even earlier, and then, it accompanies project managers until the final project performance review.

But what should that symbiosis look like? Here’s a step-by-step answer to that question.

How To Manage Project Financials – Step-by-Step Guide

Before the Project Lifecycle Starts

Never sign a project contract until you’re 100% confident it will succeed—both in execution and profitability. Once the project scope has been identified, and a general project schedule is in place, project managers should run multiple financial and resource scenarios to ensure the following:

- The company has the right specialists with the necessary skills to deliver the project successfully. Effective evaluation of resource management capabilities is crucial at this stage.

- The assigned team members are available throughout the project’s timeline or key phases, and any temporary absences won’t compromise critical deliverables.

- The actual costs of a project—including labor and other direct expenses—remain well below the agreed contract price, ensuring a healthy profit margin.

- If you have any historical data on similar previous projects, ensure that their margins were satisfactory, and that they experienced no costs overruns. Otherwise, you might reconsider starting this project!

By analyzing those financial aspects of the project, you can create accurate cost estimates and ensure that risk management starts before the project does – and before the first problems become obvious. Then, business growth is just a few steps ahead!

Planning Phase in Project Financial Management

Project cost management becomes especially impactful during the planning phase, as financial planning is an essential part of this process. At this stage, key resources—including specialized personnel, tools, equipment, and software—are allocated, giving project managers a clearer picture of the project’s true cost. It’s also essential to incorporate a proportionate share of company overheads and other indirect costs at this point to ensure that projected profitability remains strong and realistic.

Execution Phase in Project Financial Management

In project financial management, the execution phase focuses on closely monitoring budget utilization and other financial metrics—ideally in real time. As expenses and other project data accumulate, it’s critical to track for any unplanned costs, extra hours, or unexpected tasks that could lead to budget overruns. Continuous oversight during this phase combined with proactive cash flow management helps ensure the project stays financially on track and aligned with its original goals.

Post-Project Financial Analysis in Project Financial Management

The project will eventually end, but the project financial analysis is far from over; in fact, that’s when financial project management for future operations starts. After the last task is completed, take a moment to analyze the financial performance of the project and answer the following questions:

- Were there any additional expenses your team didn’t predict that affected the financial data?

- Were there any delays that contributed to the cost overrun?

- Was there anything that forced project managers to alter the budget?

Then, make some conclusions and take them into consideration before your next project – especially if it’s a similar one.

Why Is Financial Project Management So Vital?

It’s simple – whether we like it or not, money (and, in particular, higher profitability) is the ultimate goal of every company and every project. Financial management in projects aims to improve those profits even more by:

- Helping project managers make better decisions. With a complete overview of every action, billable or non-billable, they can react to any unforeseen problems and ensure that the project stays on budget regardless of the circumstances.

- Optimizing revenue forecasting. With financial analysis in your project, you can get rid of your crystal ball. Instead, thanks to the live data on all the expenses, you can predict the profitability of your project – and do the same for similar operations in the future.

- Extensive risk mitigation. By having nearly no uncertainties, you can expect the unexpected – and make it work to your advantage. Project financial management will help you do that and ensure the success of your future projects!

Best Tool for Financial Management in Projects

Dozens of milestones, hundreds of tasks, and thousands of dollars… There are many things project managers should monitor in the project. Fortunately, they can get some help from the right project finance management tools – and we have exactly what they need.

BigTime – A Single Tool For Project And Finance Management

BigTime is a project management software designed to provide project managers with everything they need to control a project from start to finish. With resource management, project overview, effective project management, finance management and advanced, AI-powered reporting, BigTime is a perfect choice for executives looking for a single source of truth on every minute and every penny allowing them to achieve business’s strategic goals.

An example of project budget management in BigTime

For those interested in financial management in project management, BigTime offers:

- Resource allocation combined with hourly rates and wages – for us, project cost management starts with the smallest, but the most crucial information in the project planning.

- Automated creation of project budget based on resource allocation combined with scenario testing for weeks and months to come – available for draft, current and historical projects.

- Advanced financial forecasting adjusted in real time, whenever a change is made.

- Cost and margin tracking for monitoring direct costs, overheads, and project profit margin for accurate profitability reporting.

- Real-time financial dashboards with KPIs such as actual vs. budgeted costs, billable utilization, and profitability

- Time and expense tracking altering the project budget with each time log.

- Customizable invoices based on automated billing workflow linked to time and expense entries for accuracy

See what BigTime can do for you right away! Book a demo and let our advisors show you how to bridge the gap between project management and finances in a few clicks and make informed decisions every time. Effective financial management starts with BigTime!