Professional Services Invoicing: Tips From the Trenches

A process to billing and invoicing might seem simple on the surface.

For small companies, generating invoices is simple. First, establish payment terms, then download an professional invoice templates, punch in your hours and rate, generate a document, check the contact details and request payment. The only requirement here is making sure all the payment details are present in the file. But what “details” should be include in every invoice you create, both for one-time and recurring payments?

Service Invoice Template for Professional Services Companies

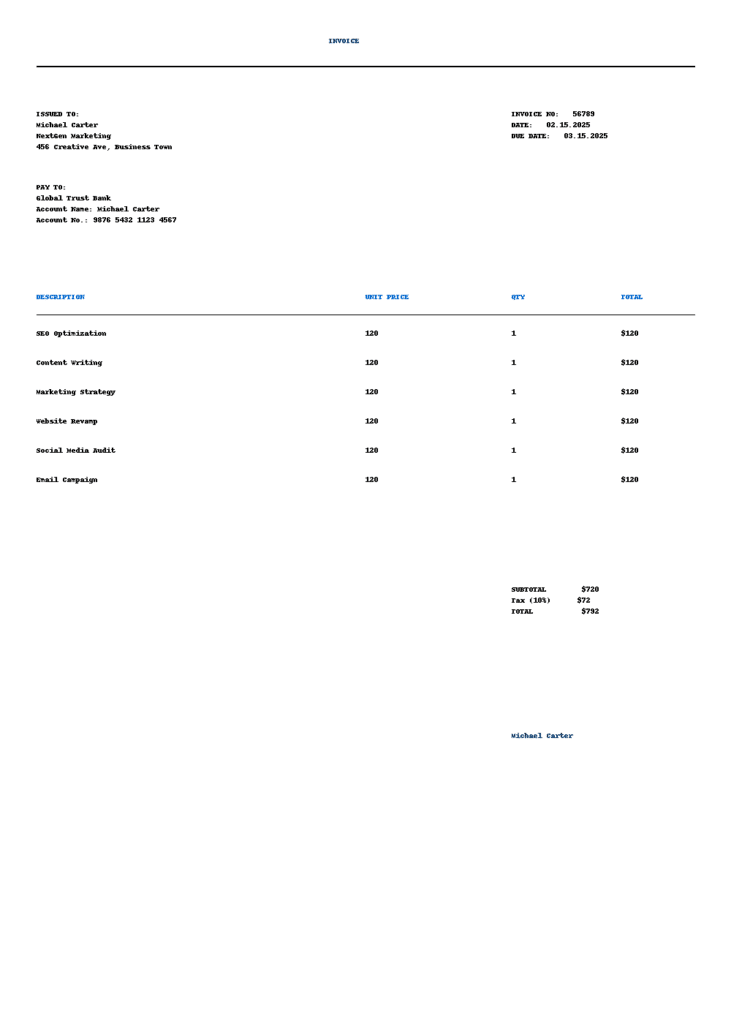

A typical template for both one-time and recurring invoices should include invoice details such as:

Basic Invoice Information

- Title: Clearly state “Invoice” at the top.

- Invoice Number: A unique identifier for tracking.

- Invoice Date: The date the invoice is issued.

- Due Date: The deadline for payment.

Service Provider (Company) Information

- Company Name and business logo.

- Address

- Phone Number

- Website (if applicable)

- Tax Identification Number (EIN, SSN, or applicable state tax ID if required)

Client (Customer) Information

- Company or Individual Name

- Billing Address

- Phone Number

Description of Services Rendered

- Itemized List of Services Rendered: Each service should be listed separately.

- Service Description: Brief but clear description of each service provided.

- Date of Service: When the service was rendered.

- Hours Worked (if applicable): For hourly-based services.

- Rate Per Hour/Flat Fee: Specify the agreed-upon rate.

- Subtotal Per Service: Multiply the rate by hours or list the flat fee.

Cost Breakdown

- Subtotal: Total cost of services before taxes and fees.

- Taxes (if applicable): Sales tax, if required (most professional services are exempt but check state laws).

- Additional Fees: Any additional agreed-upon charges, such as late fees or reimbursable expenses.

- Discounts (if applicable): Any agreed-upon reductions.

- Total Amount Due: The final amount the client needs to pay.

Payment Terms & Instructions

- Payment Due Date: Clearly state when payment is expected, as specified in payment terms of your contract.

- Accepted Payment Methods: Include key details, such as account number, and offer multiple payment options whenever possible. Multiple payment methods might increase a chance of the invoice being paid on time!

- Late Payment Terms: Any penalties for overdue payments (e.g., “A 1.5% late fee per month will be applied to overdue balances”).

Legal & Compliance Information

- Contractual Reference: If the services were based on a contract, reference the agreement.

- Refund Policy (if applicable): Outline any refund policies.

- Dispute Resolution Clause (if applicable): Briefly describe the process for resolving disputes.

- Privacy & Confidentiality Statement (if necessary): If dealing with sensitive information.

Notes & Additional Information

Contact Information for Queries: Who the client should contact for billing questions.

Thank You Note: A polite thank-you message.

How to Create Invoices in Bigger Companies? A Few Invoicing Tips

Of course, as professional service teams grow past 25 consultants, firms begin to focus on streamlining the process of creating invoices to ensure predictable cash flow and effectively manage recurring invoices.

The first step to make the process simpler is consultant billing software. But quite often, even the professional service organizations (PSOs) with thousands of team members still approach this vital task incorrectly. Invoicing is one of the few actions in a consulting firm that has the most impact on keeping the lights on (i.e., cash flow). So why don’t firms dedicate the time to getting the process right when it comes to generating an invoice for professional services?

Stop Using Excel Templates for Professional Services Invoices

A key trait of any growing services business is the ability for top management to solve problems quickly and efficiently. Using Excel spreadsheet for managing billing process and ensuring timely payments does not guarantee that.

Using Excel for invoicing is labor intensive and error prone. Many managers prepare invoices for professional services on about 10 projects on a monthly basis, and they have to download time and expenses from one system, key them into Excel invoice templates manually, and then send each invoice for approval. This takes hours and it it very easy to make mistakes due to copy and paste errors. A simple mistake could cost thousands of dollars in revenue! Is that any way to run a services business?

If Not Excel, Then What?

The simple answer to what to use in place of Excel is professional services consultant billing software. Of course, the answer isn’t really that simple. For professional services firms, consultant billing software isn’t usually offered as a standalone solution. It is part of a financial management solution, time and expense tracking tool, or services automation suite.

The biggest mistake a firm can make when deciding which type of solution to use when it comes to professional services invoicing is to pick one that is unable to accurately model their business. Here’s how to do it right.

Financial Accounting Software

When invoicing for professional services, financial accounting software is essential for tracking payments. However, in a consulting firm, invoices are more about people and projects than just debits and credits. If you’re scaling beyond a few consultants, relying solely on a project management system for invoicing and progress tracking may feel limiting.

While invoicing should integrate with your accounting process for tracking receivables and cash flow, using a separate tool doesn’t mean re-entering data manually. Most cloud-based project accounting software connects seamlessly with accounting tools, and robust solutions offer PSA integrations (professional services automation) to streamline the entire process.

Professional Services Automation

For any professional services firm truly focused on growth, the only real answer to the right process and tools to invoice for consulting services is professional services automation software. But why is it crucial for professional services looking for an invoicing software?

The value that a PSA system brings to the professional services invoicing process can be broken down into three core categories—reducing revenue leakage, driving efficiency, and improving visibility.

Consolidating invoicing and time tracking into the same system helps to eliminate revenue leakage. PSA software takes the process a step further by focusing on collecting all of the time that can be billed, and ensuring it reaches the invoicing process. Good PSA solutions will have a detailed understanding of exactly how much time is anticipated in a given period.

Based on the project schedules each PM builds, the PSA solution will alert you when things aren’t going according to plan. More importantly, it understands the difference between earning revenue and sending an invoice for professional services. This is an important distinction for any growing organization. This helps to recognize revenue properly on fixed price work, keeping the CFO out of jail (al la Enron). It also prevents project managers from being penalized because one client always pays late.

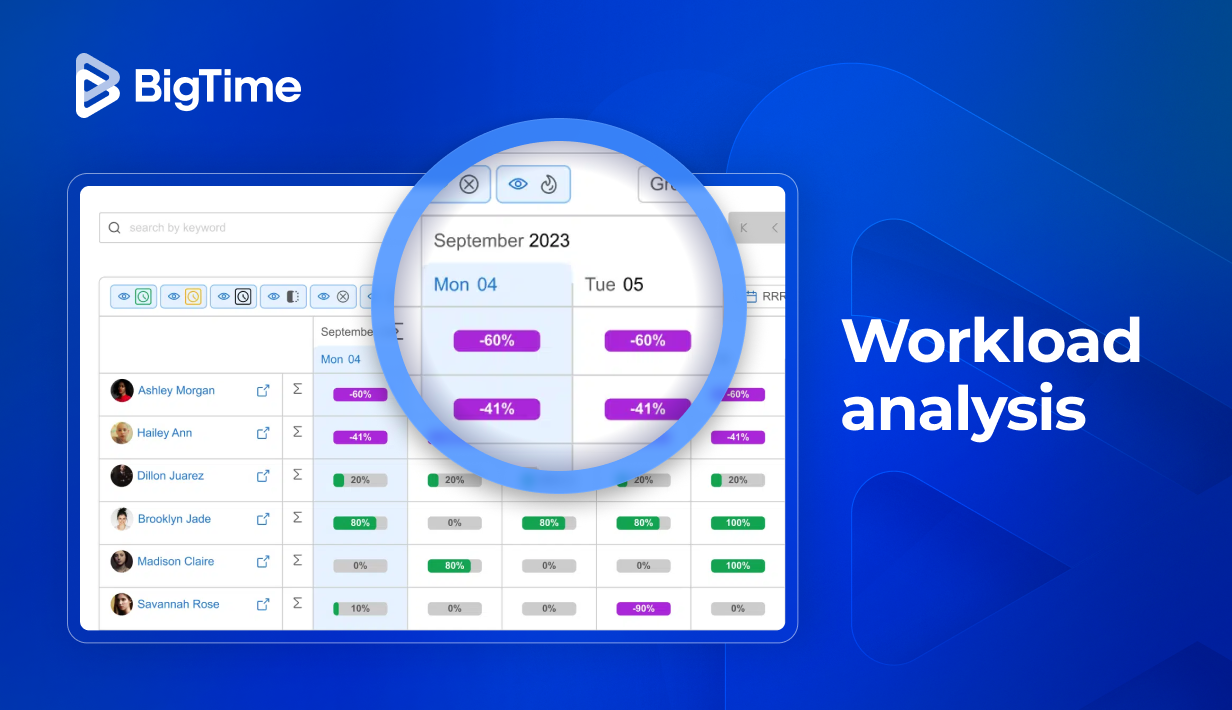

Driving Efficiency

PSA software streamlines invoicing by allowing project managers and finance teams to set billing models upfront, from contract terms to billing frequency. With all data in one system, invoicing is seamless, cutting processing time from days to hours. It also enhances accountability, giving finance teams clear insights into billed, adjusted, and pending amounts, reducing month-end workloads.

Improving Visibility

The biggest advantage of PSA software is visibility. It provides a single source of truth by transforming time and expense data into project budgets, forecasts, and profitability insights. Breaking down information silos helps teams collaborate—whether by addressing overdue invoices or leveraging client relationships to speed up payments.

Fix, Then Automate

Automation alone won’t fix a flawed invoicing process. As Steve Chong says, “automating a bad process just makes it more efficiently bad.” Before switching from Excel-based templates or upgrading tools, firms should refine their invoicing workflow to avoid inefficiencies.

The Bottom Line on Professional Services Invoicing

Professional services billing involves creating invoices for knowledge-based, revenue-generating work. However, growing firms often prioritize urgent tasks over refining their invoicing process, leading to inefficiencies and errors—especially with Excel-based invoice templates.

Establishing a structured, disciplined approach early on pays off long-term. Modern professional services software reduces errors, improves efficiency, and ensures cash flow aligns with completed work. As firms grow, a scalable invoicing process prevents future headaches.

Simplify Every Consulting Invoice With BigTime

Now, you can create any service invoice template with BigTime – and we can show you exactly how to do that. Book a demo or start a trial with our tool to learn how to create invoices in seconds!