Last updated August 1st, 2023

Preparing for a DCAA audit before it happens is the best way to set up your government contracting business for success. With the right DCAA-compliant accounting system, which we’ll cover in this post, you’ll see how integrating your time, project, and financial management will automate the process of building what we like to call a fool-proof audit trail.

But first, let’s start with the basics.

DCAA Compliance Meaning

The DCAA, or Defense Contract Audit Agency, is an independent federal agency that audits contractors’ costs and expenditures on government contracts. The DCAA’s mission is to protect the government’s interests by ensuring that contractors are complying with all applicable laws and regulations.

Organizations that do business with the government are required to be DCAA compliant. This means that their accounting systems must be able to track costs separately, such as direct and indirect costs, accounting costs, billing costs, and labor costs. They must also be able to generate reports that meet the DCAA’s requirements.

Below are some of the key elements of DCAA compliance:

- Separation of costs: Contractors must be able to track costs separately, such as direct and indirect costs, accounting costs, billing costs, and labor costs.

- Accuracy and completeness: Contractors must ensure that their records are accurate and complete.

- Timeliness: Contractors must submit their reports to the DCAA in a timely manner.

- Auditability: Contractors must ensure that their records are auditable by the DCAA.

DCAA Audits: What’s Their Purpose?

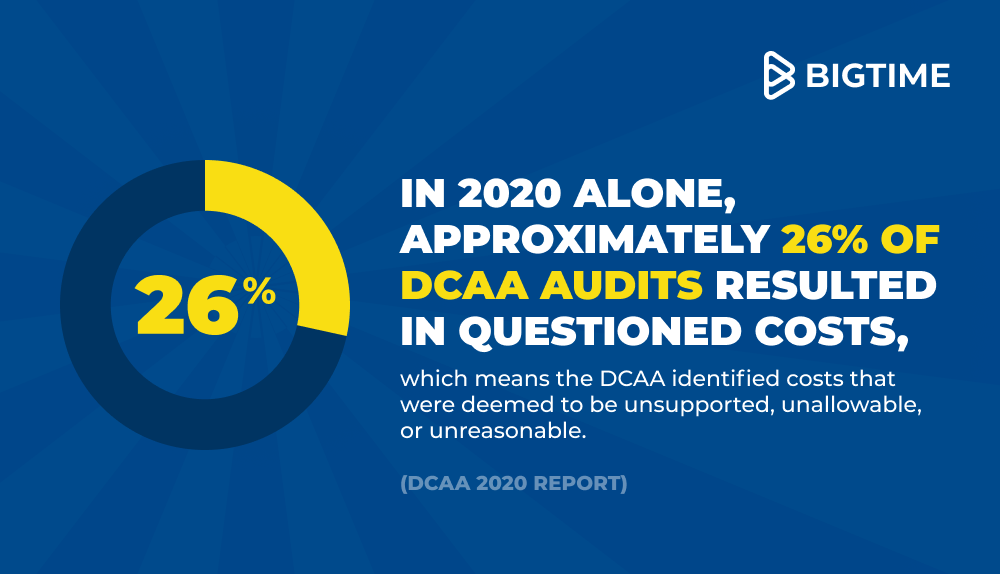

The primary purpose of a DCAA audit is to check in on the cost of a project. Money spent by the government must be classified in different ways than a standard business may go about the payment for contracted work. DCAA audits are an important part of the government’s oversight of its contracts. They help to ensure that the government is getting the best possible value for its money and that contractors are complying with all applicable laws and regulations.

Common things for the DCAA to inspect include:

- Allowable costs are those that are specifically permitted by the terms of the contract. They must be reasonable in amount, allocable to the contract, and supported by adequate documentation.

- Unallowable costs are those that are not specifically permitted by the terms of the contract. They may include costs that are considered to be personal, excessive, or otherwise not in the best interests of the government.

- Direct costs are those that can be directly attributed to the performance of a contract. They include costs such as labor, materials, and travel.

- Indirect costs are those that cannot be directly attributed to the performance of a contract. They include costs such as rent, utilities, and insurance.

- Cost pools are groups of indirect costs that are assigned to a contract based on some predetermined allocation method.

- Pooling of indirect costs is the practice of combining indirect costs from different contracts into a single pool. This can be done to simplify the allocation process or to achieve economies of scale.

DCAA-compliant timekeeping plays into compliant accounting by providing accurate time spent to bill. Each step of the compliance process is important for the audit so there isn’t a domino effect of errors. For further details on the items inspected during an audit, visit the FAR website.

Types of DCAA Audits

There are a variety of audits the DCAA can conduct before, during, and after the contract is awarded. Below are the most common types of audits and the purpose behind them.

Forward Pricing Audit

Before the contract is awarded, a forward pricing audit may be completed. During this process, DCAA auditors evaluate the contractor’s estimate of the cost of providing the goods or services to the government.

Cost Allowability Audit

The purpose of a cost allowability audit is to ensure that the contractor is not claiming costs that are unallowable, such as personal expenses or entertainment expenses. This includes reviewing the contractor’s accounting system and documentation to ensure that the costs being claimed are properly classified and supported.

Special Audit

This DCAA audit type can take place before or after the contract award. Most commonly they are in response to a request from contracting officers, who need an independent financial opinion regarding parts of a contract or the contractor’s accounting system. This request prevents the contracted work from moving forward, so this audit type receives high priority.

Closeout Audit

The purpose of a closeout audit is to ensure that the government has received all of the benefits that it was entitled to under the contract. This includes reviewing the contractor’s final invoices and ensuring that they are consistent with the work that was performed.

Progress Payment Audit

These audits are conducted to verify that the contractor is entitled to receive progress payments on a contract. The purpose of a progress payment audit is to ensure that the contractor has incurred costs that are allowable and that the costs are reasonable in amount. This includes reviewing the contractor’s work in progress and verifying that the costs being claimed are consistent with the work that has been performed.

Incurred Cost Audit

For contacts that do not have a fixed price, the DCAA will conduct an incurred cost audit after the contract award. The purpose of this audit is to determine the accuracy of a contract’s annual allowable cost representations.

Pre-Award Surveys

Small businesses are most commonly affected by DCAA Standard Form (SF) 1408 pre-award surveys. The goal of this DCAA audit is to evaluate the contractor’s accounting system to determine whether it is acceptable for the award of a government contract. In this process, the contractor must be able to demonstrate a DCAA-compliant accounting system and have it implemented before incurring any costs of the contract.

The SF-1408 evaluates:

- Cost allocations, indirect, and unallowable costs

- Time tracking system

- Labor distribution

- Billings

- Accounting system operations

Other DCAA Audits

Less common than the previous examples, there are other audits that can be performed after the contract award at the request of a contracting officer of the DCAA. These audits are reserved for high-risk situations, such as inadequate business systems and practices.

DCAA Audit Preparation

Once you know what to expect, the most important part is being prepared ahead of time. It’s always recommended to build an accounting system for your firm that automates your time tracking, billing, and reporting for a fool-proof audit trail.

DCAA Audit Checklist of Best Practices

1. Work with a trusted partner

Finding a DCAA-compliant consultant to guide you through the process can take away a lot of the stress that comes with audits. Although it’s an upfront investment, it can save you a lot of time and money down the road. DCAA consultants work with you to identify and implement the appropriate internal procedures and policies for your line of work while keeping your business efficient as it grows. They can also help train your staff on the changes and how to navigate the rules for preparing for an audit process.

2. Align your accounting system and budget

When setting up your DCAA accounting system, you should make sure it’s a reflection of how you define, operate, and manage your business along with the ability to successfully meet all compliance requirements. Having your budget and accounting system designed in the same structure will enable you to properly and easily analyze financial information.

3. Accurately capture time, expenses, and project information

Time tracking is a big part of DCAA compliance as it directly ties into the capturing of all labor hours and costs in your accounting software. Make sure you are using a DCAA-compliant time tracking software with project management capabilities that directly feeds information to your accounting software to ensure project names and codes are consistent, updated in a timely manner, and eliminate any margin of error that comes with double data entry.

4. Ensure you have the proper reporting capabilities.

The most important part of automating your audit trail is having a system that can generate (systematically, accurately, and timely) financial reports, including a statement of indirect and unallowable costs. Your reporting structure should include a chart of accounts that properly identifies, classifies, and segregates costs into appropriate projects and cost pools.

5. Documented policies and procedures.

A part of following the DCAA rules is making sure you have the documentation to back it up. Once you have your system and operation workflow in place, make sure to formally document the policies and procedures. Even more critically, it is your responsibility to make sure they’re adhered to and enforced. It won’t help to have them written down if your team can’t show them working.

DCAA-Compliant Timekeeping Software

DCAA-compliant timekeeping software like BigTime is essential for government contractors who need to ensure that their timekeeping systems are in compliance with the DCAA’s strict requirements. BigTime Software is a cloud-based time tracking and project management solution that is designed to help government contractors meet the DCAA’s requirements.

Why government contractors love BigTime:

- Accuracy and completeness: Accurately track and record employee time, including breaks, overtime, and travel time. This ensures that contractors are able to accurately bill the government for their time and expenses.

- Separation of costs: Separate direct costs from indirect costs. This is important for government contractors who need to track their costs in accordance with the DCAA’s requirements.

- Auditability: Generate reports that are auditable by the DCAA. This helps to ensure that contractors are able to pass DCAA audits with ease.

- Security: BigTime is secure and protects the confidentiality of employee timekeeping data. This is important for government contractors who need to protect sensitive information.

Frequently Asked Questions About a DCAA Audit

What does a DCAA audit do?

A DCAA audit examines the financial and accounting practices of government contractors to ensure compliance with regulations and contract terms. It verifies the accuracy of claimed costs, reviews cost allocation, and confirms adherence to government accounting standards, promoting transparency and accountability in defense contracting.

How long does a DCAA audit take?

The duration of a DCAA audit can vary but typically ranges from a few weeks to several months, depending on factors such as the complexity of the contract and the availability of documentation.

How do I prepare for a DCAA audit?

To prepare for a DCAA audit, start by ensuring your accounting system and internal controls are compliant with government regulations. Maintain accurate and organized financial records, documentation, and supporting evidence. Conduct internal reviews to identify and address any potential compliance issues, and consider working with a DCAA-compliant consultant to guide you through the process and help prepare your staff for the audit.

What conditions must I meet to remain DCAA compliant?

To remain DCAA compliant, you must maintain an adequate accounting system, implement internal controls, maintain accurate documentation, adhere to cost principles and regulations, accurately bill the government, cooperate with audits, and stay updated on DCAA requirements.

What happens if you fail a DCAA audit?

Failing a DCAA audit can result in consequences such as corrective action requests, withholding of payments, contract disallowance or reduction, contract termination or suspension, and potential legal consequences including fines and penalties.