Take care of the pennies and the dollars will take care of themselves – that popular saying is a backbone of both household and project budget. Still, with numerous costs and limited additional funds, monitoring true and estimated costs of complex operations is not a piece of cake – but it can be. Here’s how!

What Is Project Budget? Definition

A project budget in a professional services company is a structured financial plan that outlines the estimated costs, revenue, and resource allocation for delivering a client engagement within a defined scope and timeframe. It serves as a financial framework that ensures profitability, operational efficiency, and alignment with strategic business objectives.

Common Project Cost Categories in Project Budget

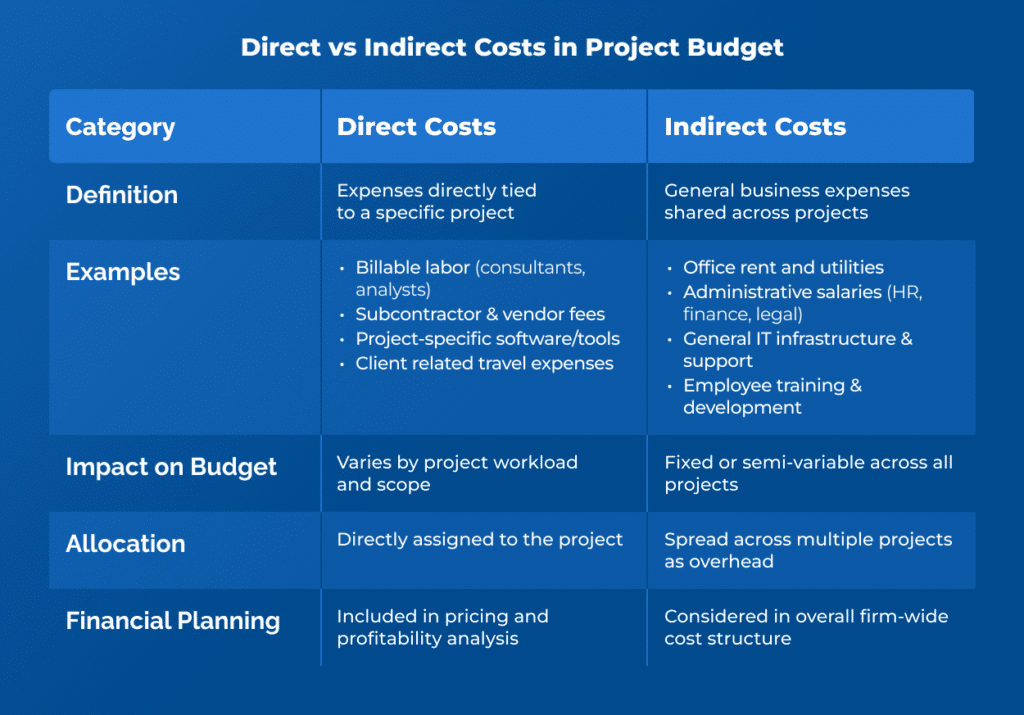

Typically, project budget accounts for two types of costs in project management: direct and indirect costs.

Direct Costs in Project Budget

Direct costs are expenses that can be directly attributed to the project and typically vary based on the project’s scope and duration. They typically include:

- Labor Costs – Compensation for billable professionals, including salaries, benefits, and payroll taxes.

- Subcontractor & Vendor Fees – Costs of external consultants, contractors, or specialized service providers engaged for the project.

- Technology & Software Expenses – Costs of tools, software licenses, and platforms required specifically for project execution.

- Travel & Lodging – Expenses related to client-site visits, including transportation, accommodations, and per diem allowances.

- Materials & Supplies – Any physical or digital resources necessary for project completion, such as reports, templates, or training materials.

Overhead Costs in Project Budget

Indirect costs in project budget, which are also often referred to as overhead costs, are costs incurred by the business that support the project but are not directly tied to a specific engagement.

- General Administrative Costs – Shared expenses such as office rent, utilities, and corporate IT infrastructure.

- Non-Billable Staff Support – Salaries of personnel who provide support functions (e.g., HR, finance, legal, marketing).

- Training & Professional Development – Costs associated with upskilling employees working on the project.

As can be easily seen from the list above, such extensive overhead costs costs can have a significant impact on budget planning, or even of the final profitability of the entire project. Still, despite their importance, the overhead costs often turn out to be unexpected costs, as many project managers fail to account for them in their budgeted costs. This is a common mistake that should be avoided at all cost!

How to Create a Project Budget?

Budgeting process has to account for dozens of elements and financial constraints that affect the final project cost and income. Calculating labor costs is not enough here!

Fortunately, we know a battle-tested project budgeting process you can use in your project management – regardless of the project scope you try to complete.

Step 1: Define the Project Scope and Deliverables

Every project budget highly depends on the project tasks and project deliverables that translate directly into tracked hours and, consequently, labor costs. For that reason, all the tasks should be taken into consideration before the project starts – but how to do that?

It’s simple:

- Clearly outline the project objectives, deliverables, and timeline based on client agreements.

- Identify key tasks, milestones, and resource requirements needed for successful project completion.

- Determine the pricing model (fixed fee, time and materials, or value-based pricing).

- Use historical data on previous projects to create accurate estimates for every task and milestone.

Importantly, as the project progresses, it might be subject to a scope creep – or a sudden, unforeseen change in the

Step 2: Identify Direct Costs

Before you go on to create an actual budget, you also need to account for the company-wide costs your project have to cover. To do that, calculate costs that are directly tied to the project and are its important budget component, including:

- Labor Costs – Estimate billable hours for consultants, analysts, or subject matter experts.

- Subcontractor & Vendor Fees – Include costs for external professionals engaged in the project.

- Technology & Software – Budget for tools, licenses, or subscriptions needed for project execution.

- Travel & Lodging – Plan for site visits, client meetings, or relocation costs if applicable.

- Materials & Supplies – Account for documentation, reports, or training materials.

Step 3: Overhead Allocation

Determine the proportion of general business expenses to allocate to the project, including:

- Office Rent & Utilities – A share of workspace costs if not directly billable.

- Administrative Support – HR, finance, and other department budget supporting the project and the company as a whole.

- Training & Development – Any upskilling needed for project execution.

Typically, verhead costs are distributed based on labor hours or revenue percentage. In other words, the shorter the project, the smaller fraction of company overheads it should cover.

Step 4: Add Contingency and Risk Reserves

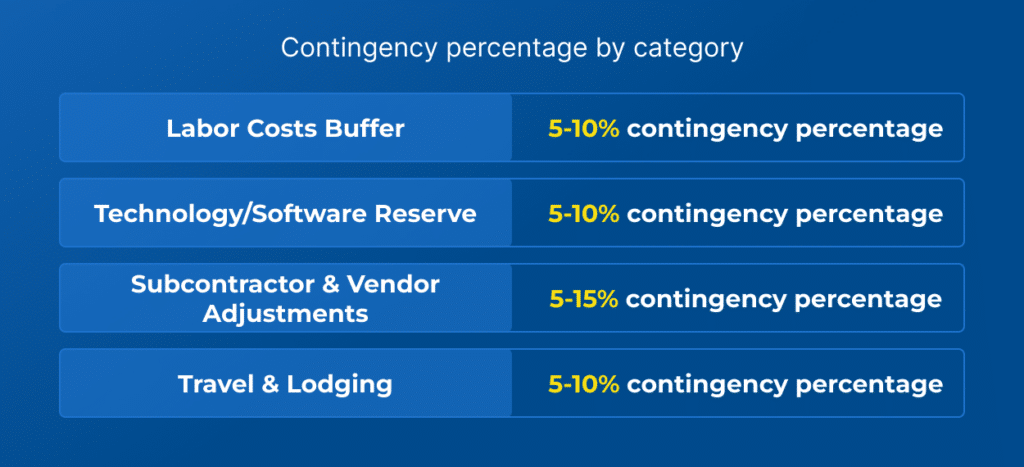

Adding a contingency budget (or contingency reserves) is essential in professional services projects to mitigate unforeseen risks and cost overruns. This step ensures that financial buffers are in place to handle unexpected challenges without jeopardizing project profitability or client relationships.

How Can Project Stakeholders Calculate Contingency Reserves?

To determine what contingency fund might be needed and ensure project’s success, project management should:

- Identify potential risks, such as scope creep, project delays, and market and economic factors. Use information on project performance from similar projects to create a more accurate budget estimate.

- Determine the contingency percentage. A typical contingency reserve for professional services projects ranges from 5% to 15% of total project costs. The exact percentage depends on project complexity, risk tolerance and historical data from past projects.

- Allocate contingency across budget categories. Applying a blanked percentage for all the associated costs might not be enough, since different parts of the work breakdown structure might generate different fractions of total costs. To make sure that the money allocated ends up in the right place, contingency reserves can be distributed strategically by category.

Step 5: Determine Revenue & Profit Margin

At this stage of creating a project budget, all your project costs should already be accounted for. Now it’s time for the big reveal – or calculating the project profitability based on its actual costs. In project budget management, this is the moment of truth!

To calculate the revenue and, then, the actual profitability of the project:

- Define billing rates per role and service provided – the best project management tools should provide you with that information right away.

- Calculate projected revenue based on estimated billable hours or fixed fees, as well as additional costs.

- Ensure the budget meets profitability targets, factoring in desired margins (e.g., 20-40%).

Step 6: Review and Approve the Budget

Filling in the project budget template is not enough to convince project stakeholders that your project budget is free of unexpected expenses. To ensure that there are no loose ends that will afect project’s success, project managers need to:

- Validate all estimates with project managers, finance teams, and executives.

- Cross-check budget alignment with the client contract and expectations.

- Obtain necessary approvals before finalizing and implementing the budget.

Once the final approvals are made, you can start allocate resources – creating a project budget is done!

An example of project budget shared with key stakeholders in BigTime

Project Budget Template – A Perfect Way To Control Project Costs

Of course, even with all the project budgeting tips, creating project budget from scratch is not a simple task. Fortunately, with a project budget example, it can get a bit easier!

Creating A Project Budget With A Template – Budget Planning Made Simple

1. Project Overview

- Project Name: [Enter Project Name]

- Client Name: [Enter Client Name]

- Project Manager: [Enter Project Manager]

- Start Date: [Enter Start Date]

- End Date: [Enter End Date]

- Pricing Model: [Fixed Fee / Time & Materials / Value-Based]

- Total Budget: [Enter Total Project Budget]

2. Cost Estimation

A. Direct Costs

- Labor Costs: Estimated cost for billable staff, including consultants, analysts, and subject matter experts. [Enter Amount]

- Subcontractor & Vendor Fees: Costs associated with hiring external consultants or service providers. [Enter Amount]

- Technology & Software: Expenses for project-specific tools, software licenses, and cloud services. [Enter Amount]

- Travel & Lodging: Estimated costs for transportation, accommodations, and per diem expenses. [Enter Amount]

- Materials & Supplies: Costs for reports, documentation, training materials, and any physical or digital resources. [Enter Amount]

- Other Direct Costs: Any additional costs that are directly tied to project execution. [Enter Amount]

- Total Direct Costs: [Enter Total]

B. Indirect Costs (Overhead Allocation)

- Office Rent & Utilities: Allocated portion of general business expenses. [Enter Amount]

- Administrative Salaries: Costs of non-billable support staff such as HR, finance, and legal. [Enter Amount]

- General IT Infrastructure: Costs related to company-wide technology, software, and security systems. [Enter Amount]

- Employee Training & Development: Training expenses for upskilling employees involved in the project. [Enter Amount]

- Other Indirect Costs: Any additional overhead costs that contribute to project support. [Enter Amount]

- Total Indirect Costs: [Enter Total]

3. Contingency & Risk Reserves

- Scope Creep Allowance: Estimated buffer for potential scope expansion. [Enter Amount]

- Project Delays & Rework: Reserve to cover unforeseen delays or quality issues. [Enter Amount]

- Technology Adjustments: Funds allocated for unexpected software upgrades or additional integrations. [Enter Amount]

- Economic Fluctuations: Contingency for currency exchange rate fluctuations, inflation, or market risks. [Enter Amount]

- Total Contingency Budget: [Enter Total]

4. Revenue & Profitability Analysis

- Billing Rate Per Role: [Enter Details]

- Projected Billable Hours: [Enter Estimated Hours]

- Estimated Revenue: [Enter Amount]

- Target Profit Margin (%): [Enter Percentage]

- Expected Profit: [Enter Amount]

5. Budget Approval & Monitoring

- Budget Approved By: [Enter Name & Role]

- Approval Date: [Enter Date]

- Budget Review Frequency: [Weekly / Monthly / Quarterly]

- Monitoring & Adjustments: Notes on tracking actual costs vs. budgeted amounts and necessary adjustments. [Enter Details]

Can Project Management Software Make The Process Easier?

Yes, project management tools can significantly streamline the process of creating and managing a project budget in professional services companies. These tools enhance accuracy, efficiency, and financial visibility by automating calculations, tracking expenses, and integrating resource allocation.

Assign Resources and Watch Project Budget Create Itself in BigTime

Unexpected expenses? Inaccurate project management? Incorrect resource allocation? Not with BigTime!

BigTime bridges the gap between resources and finances by using pre-defined rates to create accurate estimates and error-free project budget automatically, and updating it every time you make a change to your plans. It will also generate automated reports, helping project managers avoid mistakes and create perfect budgets.

Sounds good? See what else BigTime can do for you – book a demo now!